There are many variations on a SIB; you will need to work with your partners to develop a deal structure that will enable your unique programme. In addition to commissioners, investors, and service providers, several other important participants are often involved. Many crossover roles are possible, and some deals have large numbers of service providers, along with senior and subordinate investors.

|

Intermediary |

Often raises capital and brings the other stakeholders together to agree upon the transactional details. Can be integral to the success of a SIB and may be involved from the very start of the concept through to delivery, performance management and quality control. |

|

Evaluator

|

Independent evaluation firm, research institution or government agency that is sometimes used to evaluate the outcomes. Technically not needed but may be provided in complex SIBs. |

|

Validator |

An auditor (can be employed by the commissioner or be independent) that validates the rigour of the outcome evaluation. Often the commissioner will have access to data sources to take on this function. |

|

Lawyers |

Advise on structure of the deal. As a SIB is not a single defined legal structure you can pick up and use, it takes bespoke and often unique legal work to set up. Lawyers will be required to help with contracts, Term Sheets and Shareholders' Agreements. |

|

Special Purpose Vehicle (SPV) |

A legal entity, called a Special Purpose Vehicle, created to hold the contract, receive investment and pay the service provider. An SPV is a company with limited liability that is set up to protect the stakeholders and separate the contract from the delivery organisation’s other activities, reducing their risk and making it easier for investors to fund the specific contract. While it may sound like it adds complexity to an already multi-faceted undertaking, it doesn’t have to be very expensive – either financially or in resources – and can be very advantageous. |

Advantages of an SPV:

-

It can protect the provider by transferring risk to the investor, especially in substantial (above £1-1.5M) or complex structures (as per Go Lab's guidance). Assuming they don’t choose to co-invest, a provider’s main risk is then reputational.

-

SPVs can be accredited by the Centre for SIBs in order to be eligible for Social Investment Tax Relief.

Potential downsides of an SPV:

-

Loss of control and depth of relationship with commissioners, to some extent, as the provider is no longer the interface with the commissioner but rather a sub-contractor carrying out the service.

-

The investment required for set up, and then to wind it down at the end of the contract. Enough cushion needs to be built into the outcome payments to pay for this. There may be other ways to transfer risk without the expense of an SPV.

There is enormous variation on SIB structures, and the structure that is right for your programme will flow out of discussions with your partners on the intervention, specific providers, payment legal structure, and other factors. In all cases, service providers must be aware of the reputational risk in case of poor performance.

There are three main types of structure:

- Direct

The contract is signed between the commissioner and the service provider (or SPV controlled by service provider).The service provider is responsible for implementation and performance management.Here, the service provider bears the risk of non-payment for not achieving outcomes, after the initial investment

- Intermediated

The contract is signed between the commissioner and the investor (or investor-controlled SPV).The service provider risks termination of contract in case of poor performance.

- Managed

The contract is signed between the commissioner and an intermediary (or SPV controlled by intermediary)

OECD, Adapted from Goodall, 2014

Tool

SIB Structure Considerations

Contributed by Numbers for Good

Download Tool

A summary guide to the typical features of different kinds of SIB – those where the lead contract is respectively the SPV, the prime contractor or the service provider.

There follow examples of three different SIB structures.

1. Direct contract with provider-owned SPV

2. Managed contract, with investor signing contract with intermediary-owned SPV

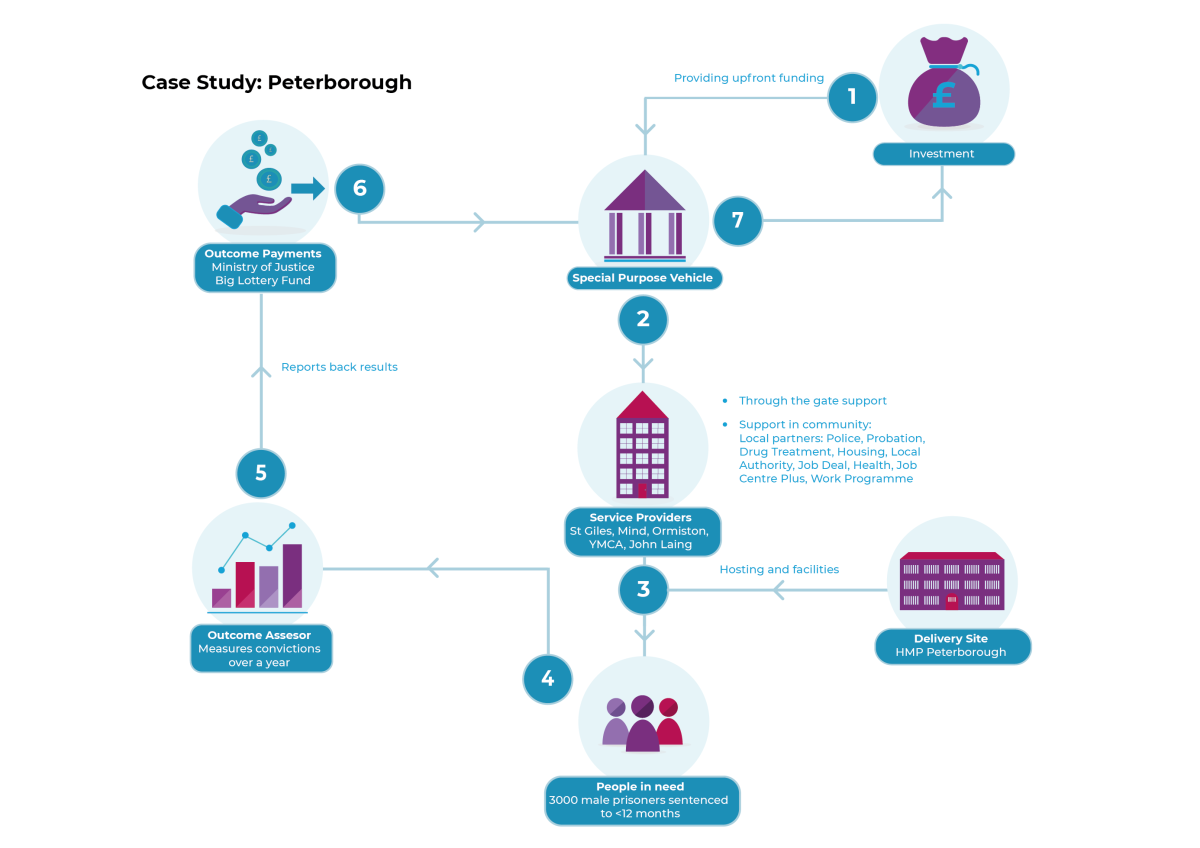

The first SIB was designed to reduce recidivism at HMP Peterborough. It was targeted at prisoners serving sentences of less than 12 months, a group known to have high reoffending rates.

Peterborough SIB return arrangements

The SIB was structured to pay up to 13.5% of the original investment, if the rate of reoffending was reduced by more than 7% across three cohorts, compared to average figures across the entire prison.

To trigger payment for a single cohort, the reoffending rate had to be reduced by 10%.

Results for the first cohort showed a reduction of 8.6%, which would be enough to trigger payment if the second cohort showed a similar reduction.

The structure was very complicated, requiring a consortium of several service providers. The intermediary, Social Finance, coordinated not just the key stakeholders but also the agencies and partners working with the beneficiary group.

3. Mixed model SIB – shared risk contracting

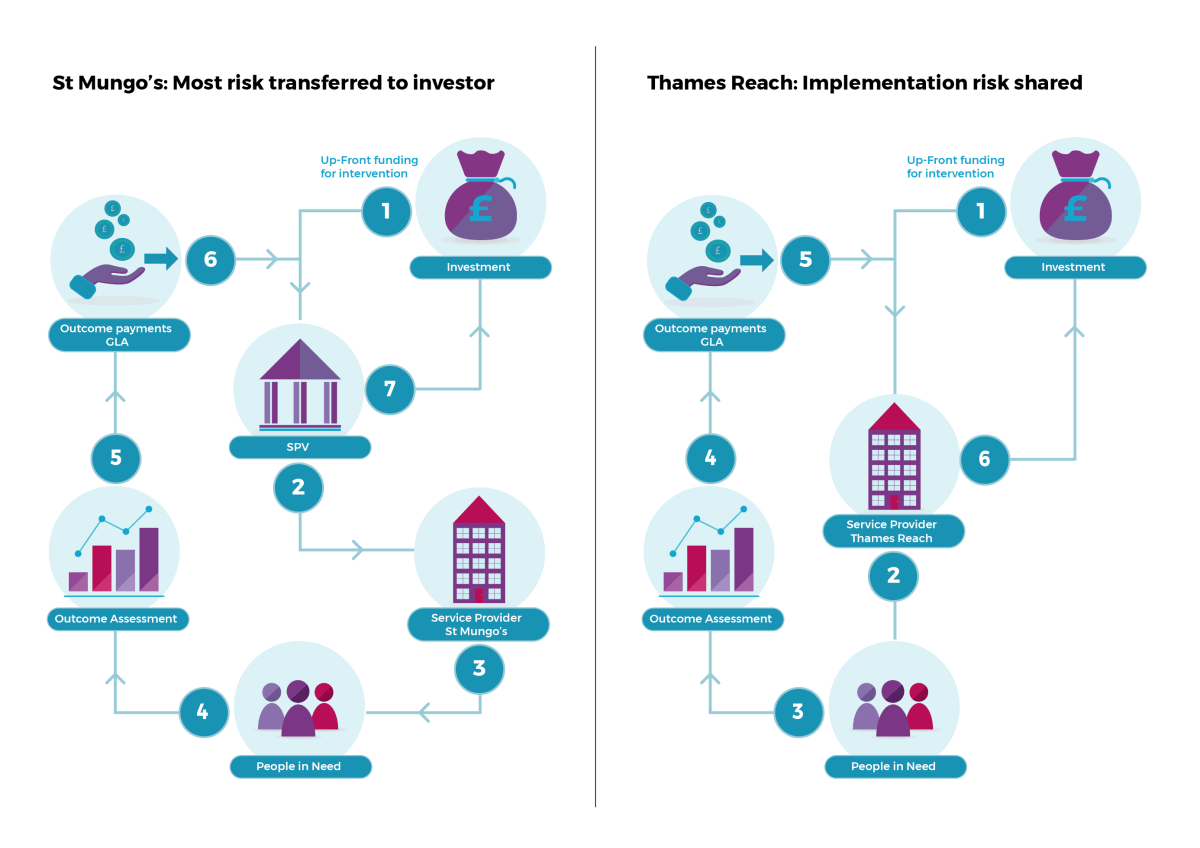

Within the same SIB, a consortium of service providers may develop different structures. As an example, St Mungo’s and Thames Reach partnered to deliver the London Homelessness SIB, launched in November 2012, to improve the outcomes for rough sleepers whose needs were not being met by existing services and who were not being targeted by other interventions.

To finance their contracts:

- St Mungo’s established an SPV, which holds the risk, while

- Thames Reach decided on a shared risk approach through unsecured loans.

St Mungo’s equity investment is at risk before the bonds, so some of the risk was still shared.

Source: DCLG, Qualitative Evaluation of the London Homelessness SIB, 2014

Masterclass: Layered Capital Structure

Contributed by Brookings

Some SIBs will be financed by several investors, rather than just one.

In these cases, there may be a senior lender – one who will have the highest priority of repayment once outcomes are met – and a subordinate lender. Some SIBs will also have a grant maker – an investor who is not paid even if outcomes are met, while others may have investment guarantees, which are triggered to pay back investors if the outcomes are not met.

Tool

SIB Implementation Plan

Contributed by ThinkForward

Download Tool

At this point, it may be useful to plan your route to the start of the project. This plan is for use after the ‘green light’, when all parties have made the decision to proceed, but contracts are not yet signed and delivery has not yet begun. It is high-level, leaving scope to customise and add detail.