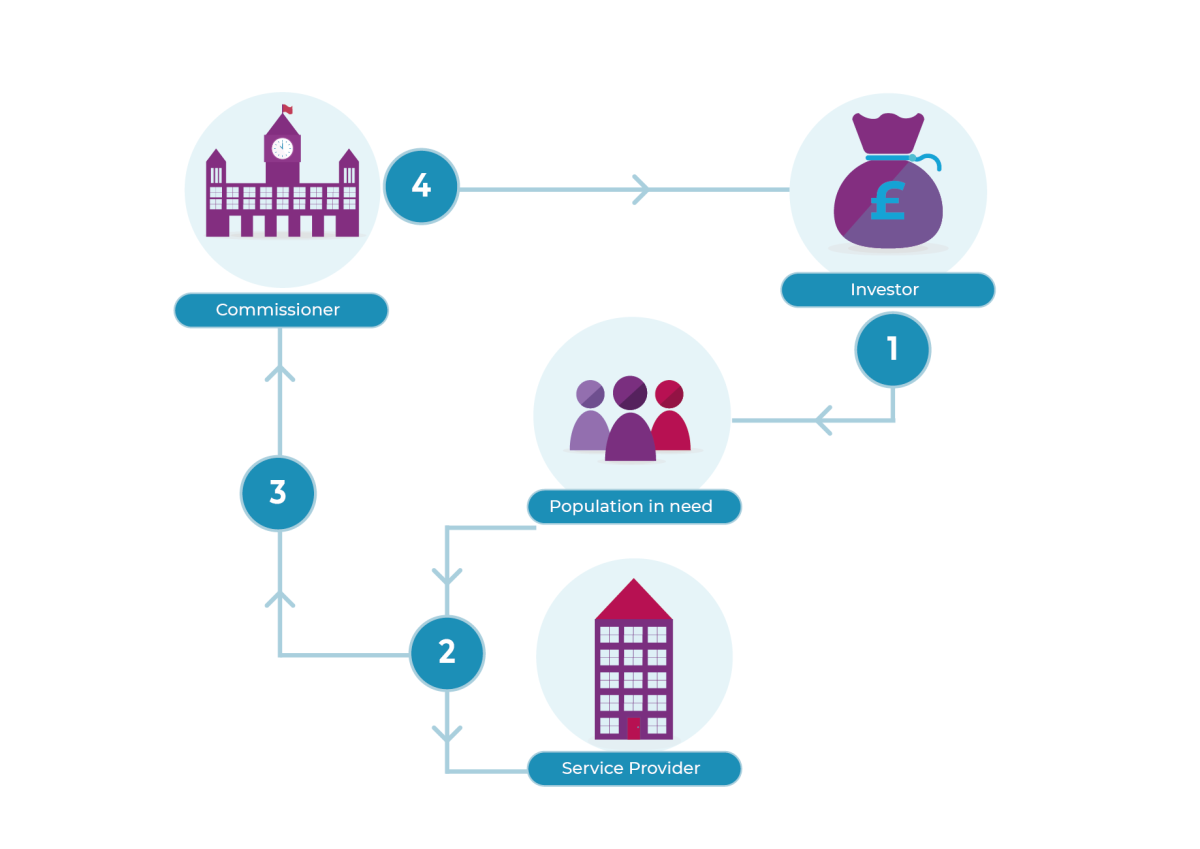

While SIBs can be structured in a variety of ways, sometimes with multiple providers, commissioners, or investors, and often involving other stakeholders such as intermediaries and evaluators, the fundamental activities are as follows:

- The investor provides working capital to the service provider at the beginning of the SIB

- The service provider works with the participants to deliver the programme, and if all goes well the desired social outcomes are achieved along the way

- As the programme progresses, the commissioner checks that the desired social outcomes have indeed been achieved

- If the commissioner is satisfied that the desired social outcomes have been achieved, payments are made (sometimes indirectly) to the investor, following a rate of return agreed upfront

In some variations, the delivery organisation may choose to share in the risk and be rewarded for achievement of outcomes. See Phase 3 of SIBs Step By Step for more details.

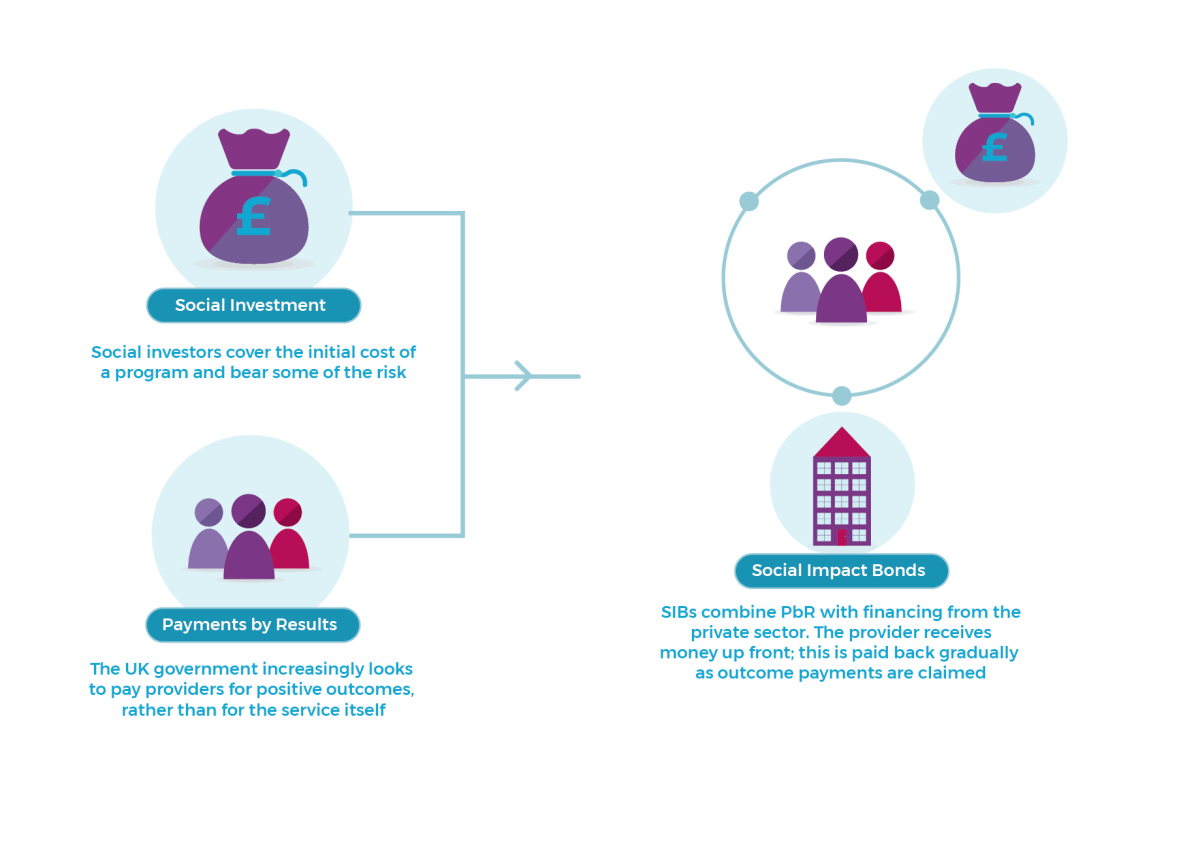

How is a SIB different from standard payment by results contracting?

It is the involvement of a social investor, who bears the financial risk, that makes a SIB different from standard payments by results contracting. SIBs have been a very small part – less than 1% - of the estimated £15 billion PbR market. (Social Spider Briefing on Social Impact Bonds).